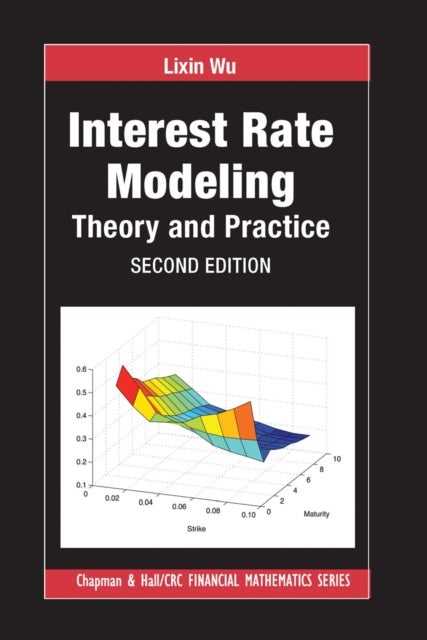

Interest Rate Modeling av Lixin Wu

529,-

<P>Containing many results that are new, or which exist only in recent research articles, <B><I>Interest Rate Modeling: Theory and Practice, 2nd Edition</I></B>portrays the theory of interest rate modeling as a three-dimensional object of finance, mathematics, and computation. It introduces all models with financial-economical justifications, develops options along the martingale approach, and handles option evaluations with precise numerical methods.</P><B><br/><br/><P>Features</P><br/><br/><UL></B><br/><br/><P><br/><br/><LI>Presents a complete cycle of model construction and applications, showing readers how to build and use models</LI><br/><br/><P></P><br/><br/><P><br/><br/><LI>Provides a systematic treatment of intriguing industrial issues, such as volatility and correlation adjustments</LI><br/><br/><P></P><br/><br/><P><br/><br/><LI>Contains exercise sets and a number of examples, with many based on real market data</LI><br/><br/><P></P><br/><br/><P><br/><br/><LI>Includes comments