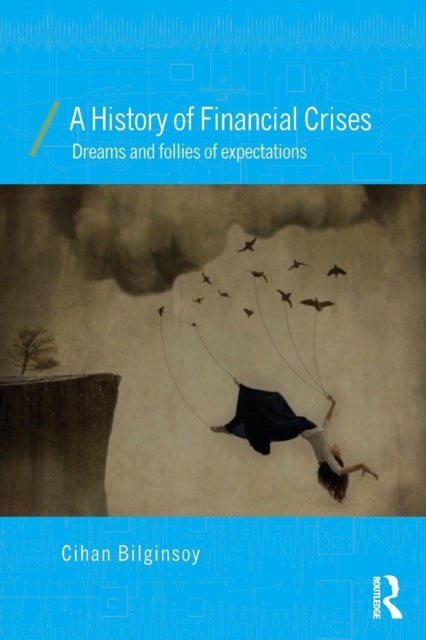

A History of Financial Crises av Cihan Bilginsoy

849,-

<P>"Once-in-a-lifetime" financial crises have been a recurrent part of life in the last three decades. It is no longer possible to dismiss or ignore them as aberrations in an otherwise well-functioning system. Nor are they peculiar to recent times. Going back in history, asset price bubbles and bank-runs have been an endemic feature of the capitalist system over the last four centuries. The historical record offers a treasure trove of experience that may shed light on how and why financial crises happen and what can be done to avoid them - provided we are willing to learn from history.</P><P></P><P>This book interweaves historical accounts with competing economic crisis theories and reveals why commentaries are often contradictory. First, it presents a series of episodes from tulip mania in the 17<SUP>th</SUP> century to the subprime mortgage meltdown. In order to tease out their commonalities and differences, it describes political, economic, and social backgrounds, identifies the pri